Prepare a complete tax return with all appropriate schedules and forms

You have three requirements for this writing assignment:

- Prepare a complete tax return (with all appropriate schedules and forms). Use the pdf files from the IRS website.

- Prepare a business letter to the taxpayer. (1 page)

- Prepare a research paper (2 pages) about the topics related to the taxpayer’s tax returns. The research paper is to be APA format, double spaced, and the font should be Times New Roman 12.

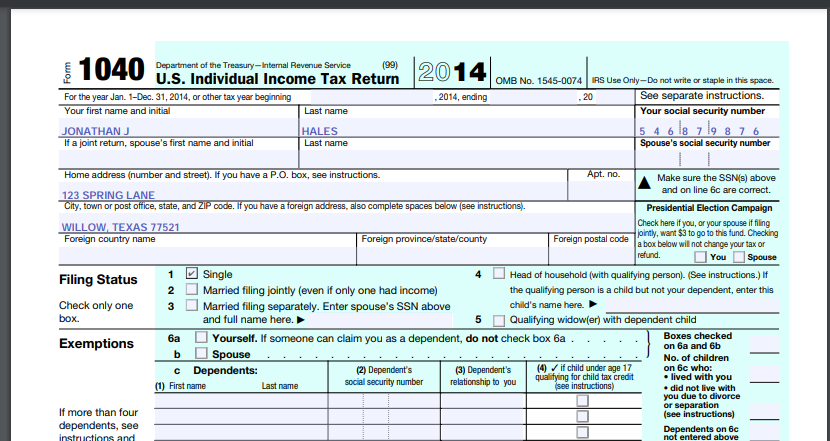

Jonathan Hales attended State University as a part-time student during the year. Jonathan lived at home with his parents while working a part-time job in order to partially support himself. The following information relates to his current tax year:

• Jonathan’s social security number is 546-87-9876

• His mailing address is 123 Spring Lane, Willow, Texas 77521

• Jonathan is a U.S .citizen

• Jonathan was single during the entire year

• Jonathan turned 19 on July 1

• Jonathan is not permanently and totally disabled

• Jonathan does not have any children or provide support for anyone else except for himself

• Jonathan lived in a room in the basement of his parents home for all 12 months of the year

• In addition to the room, Jonathan’s parents also provided Jonathan with a car, food, health insurance, clothing, education and car insurance with a total value for the year of $8,500 Jonathan Hales received the following income during the year:

| Gross Wages | Federal Taxes Withheld | State Taxes Withheld | |

| The Colony | $4,675 | $0 | $0 |

| The Rock | $790 | $0 | $0 |

| The Pool | $2,235 | $175 | $0 |

Jonathan received $15 in interest income from the First Bank of Texas during the year. Jonathan did not own, control or manage any foreign bank accounts nor was he a grantor or beneficiary of a foreign trust during the tax year. Jonathan had no itemized deductions. Jonathan does not want to contribute to the Presidential Election Campaign. He would like to receive a refund (if any) of any tax he may have overpaid for the year. His preferred method of receiving the refund is by check.

Answer preview for Prepare a complete tax return with all appropriate schedules and forms

Access the full answer containing 1400 words by clicking the below purchase button