Money and Banking

Topic: Money and Banking.

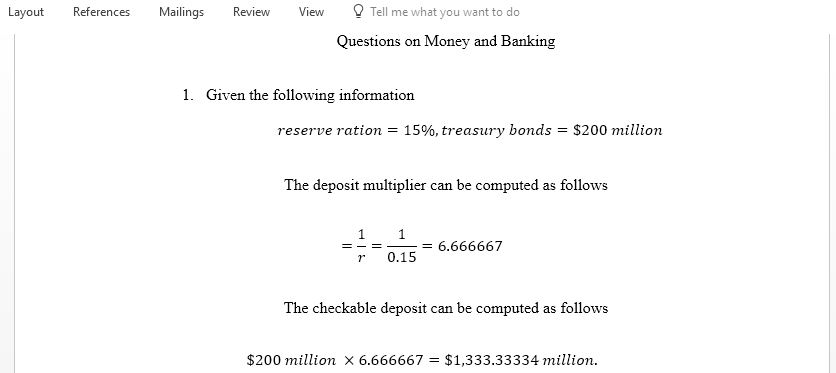

1. According to the simple deposit expansion model, if the required reserve ratio is 15% and the Fed sells $200 million of treasury bonds, what will happen to checkable deposits? Explain two critiques of this model.

2. Suppose the monetary base is $500 million, the required reserve ratio is 12%, and the currency-deposit ratio is 30%. What would the excess reserve ratio need to be produce $800 million in the money supply. Holding everything else constant, what effect would an increase in the excess reserve ratio have on the money supply?

3. State whether the following statement is true or false AND explain why:”Adecrease in the discount rat will always cause a decrease in the federal reserve funds rate.”

4. Suppose on any given day there is an excess demand of reserves in the federal funds market. What would be the appropriate action for the Fed to take to keep the federal funds rate at its current level? Would this action be an example of conventional or unconventional monetary policy, and would it be considered defensive or dynamic?

5. Explain how a central bank can fuel asset bubbles. Give some suggestions on how a central bank can help to avoid this issue. Also, give some explanations as to why a central bank may not be able to stop asset bubbles.

6. What is Inflation targeting and explain why it can be difficult to pursue this over a period of time. (hint: pretend you are a central banker and trying to keep high inflation under control…e.g. 1960s America)

7. Assume that the Bank of England decided to reduce its purchases of U.S. treasury bonds and instead held more dollars on deposit at the Fed. How this will affect the monetary base? What would be the appropriate monetary policy action to offset such a change?

8. Over the month of March 2020, in an attempt to deal with the economic slowdown caused by the coronavirus, the Fed announced and implemented a new QE (Quantitative Easing) program with an immediate $80 billion buy. Do you think the $80 billion buy had an effect on the money supply? If your answer is yes, please explain the size and nature of the possible effect.

Answer preview for Money and Banking

Access the full answer containing 835 words by clicking the below purchase button.