Each coursework group will be allocated two real-life companies that are publicly traded on a U.S. stock market

Each coursework group will be allocated two real-life companies that are publicly traded on a U.S. stock market. The two companies A and B are Discovery and Netflix. The PERMNO and GVKEY numbers are important for the collection of data on WRDS.

1.2 Part 2

The senior management of Company A employs you to advise them on the cost of capital the company should use to calculate the net present value and decide whether or not to undertake a new investment project. You may assume that the new project is comparable to the average of the company’s existing projects in all respects. Make sure you correctly identify which of your two companies is “Company A”. Note also that you were allocated randomly drawn and randomly paired companies. Therefore, Company B is probably not a useful comparable for Company A’s new project.

Required tasks:

When you answer each of the below sections (a), (b), and (c), clearly explain your data sources, calculations and methods. Among other things, note explicitly whether your results are in terms of monthly or yearly returns (either or both are acceptable as long as clearly labeled). Briefly describe and justify the data and (proxy) measures you are using. State and discuss any assumptions you are making (including assumptions about the financing of the project).

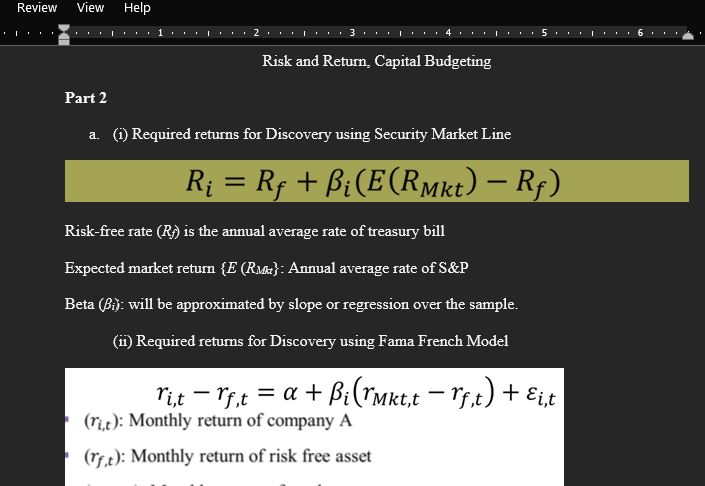

(a) Calculate investors’ required returns on Company’s A’s equity.

(b) Calculate Company’s A’s debt cost of capital. The bond yield can be calculated as Yield = risk-free rate + credit spread. Data on the approximate credit spread for a given credit rating is provided in the section on Debt data below. For simplicity, you may assume that the only securities outstanding of the company are common stock (equity) and long-term debt. Note that the after-tax cost of debt is lower than the pre-tax cost of debt if there is a tax advantage of debt relative to equity (interest tax shield).

(c) Calculate the cost of capital (that is, the appropriate discount rate to calculate the net present value) of Company A’s new investment project.

Answer preview for Each coursework group will be allocated two real-life companies that are publicly traded on a U.S. stock market

Access the full answer containing 1113words by clicking the below purchase button.