Compute the cost of borrowing in foreign currencies

This week you will learn to compute the cost of borrowing in foreign currencies. This is an important concept since the MNC uses a multitude of currencies to hedge and hopefully reduce their borrowing costs.

PROBLEM SETS

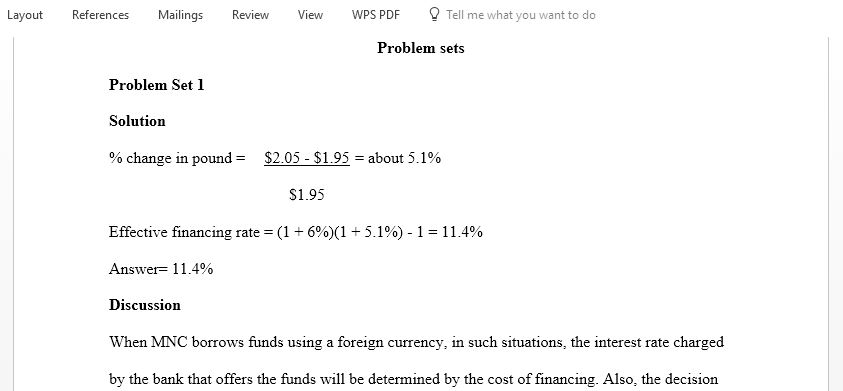

- Assume the U.S. one-year interest rate is 8%, and the British one-year interest rate is 6%. The one-year forward rate of the pound is $1.97. The spot rate of the pound at the beginning of the year is $1.95. By the end of the year, the pound’s spot rate is $2.05, based on the information, what is the effective financing rate for a U. S. firm that takes out a one-year, uncovered British loan?

- Assume Avarice Corporation, a U. S. based MNC, obtains a one-year loan of 1,500,000 Malaysian Ringgit (MYR), at a nominal interest rate of 7%. At the time the loan is extended, the spot rate of the ringgit is $.25. If the spot rate of the ringgit in one year is $.28, the dollar amount initially obtained from the loan would be $_____________, and how many $ ___________would be needed to repay the loan?

- Maston Corporation has forecasted the value of the Russian ruble for the next tear as follows:

OUTCOME

| PERCENTAGE CHANGE | PROBANILITY OF |

| -5% | 20% |

| -3% | 50% |

| 1% | 30% |

If the Russian ruble borrowing rate is 30%, the expected cost of financing a one-year loan in rubles would be what?

Answer preview for Compute the cost of borrowing in foreign currencies

Access the full answer containing 560 words by clicking the below purchase button